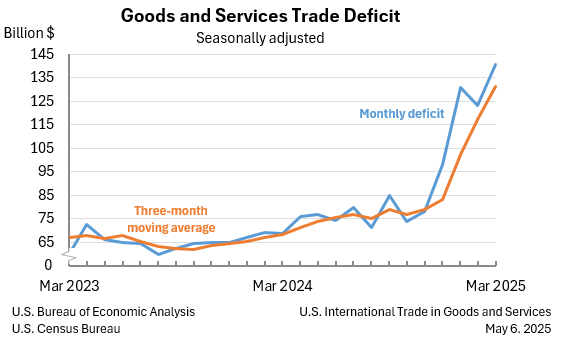

The United States of America elected a leader, Donald J Trump, who supports balancing their trade deficit for different nations with the use of Federal Tariffs. Federal tariffs apply to goods that the Government has deemed taxable. Donald Trump notably on April 2nd, 2025 applied reciprocal tariffs to nation state imports to USA. For example, if China implements tariffs on USA Goods and Services, the USA would act in kind.

Trump also noted that there can be other barriers to USA products entering other nations, such as:

- Currency manipulation

- Value-Added Taxes (VAT)

- Regulatory and technical barriers

- Import barriers and licensing restrictions

- Customs barriers and trade facilitation issues

- Sanitary and phytosanitary measures

- Intellectual property rights issues

- Discriminatory practices favoring domestic enterprises

- Barriers to cross-border data flows and digital trade

- Investment barriers

- Subsidies and anticompetitive practices

- Weak labor and environmental standards

- Bribery and corruption

- Pollution havens

Now, what is the goal? Well Trump has stated he uses tariffs to incentive countries to become more fair to USA. These incentives promote trade deals with a goal to limit the barriers for USA products and services.

The money is collected at ports of entry for goods which have a tariff applied. As of May 8, 2025, the U.S. Treasury reported collecting $46.6 billion in tariff revenue for the year, a 46.3% increase from the same period in 2024. These are significant revenues and incentives for countries to lower the barriers.

Trade Surplus and Deficit Data:

There is constant debate on what economic effect tariffs have on the US Economy. See the following critiques of tariffs from the Mises Institute:

To be continued.